IRS 14446 2023-2025 free printable template

Show details

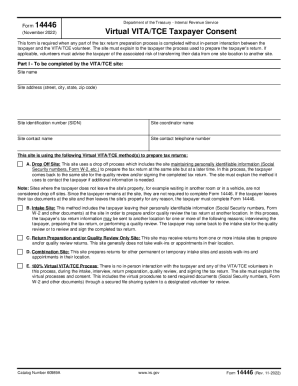

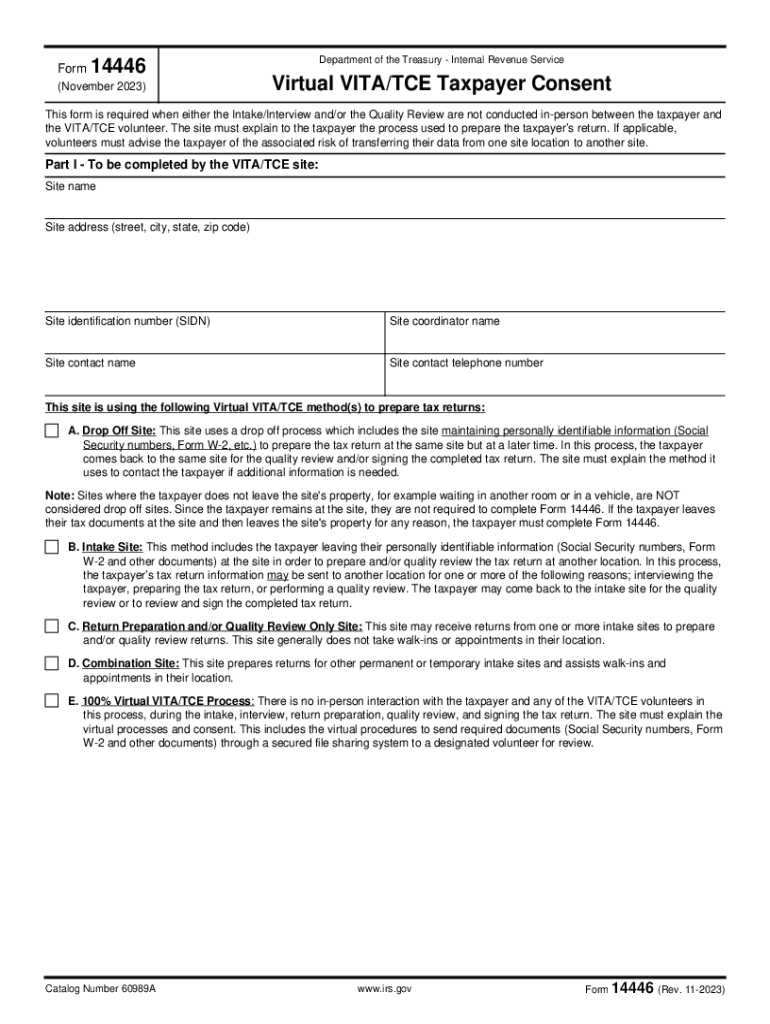

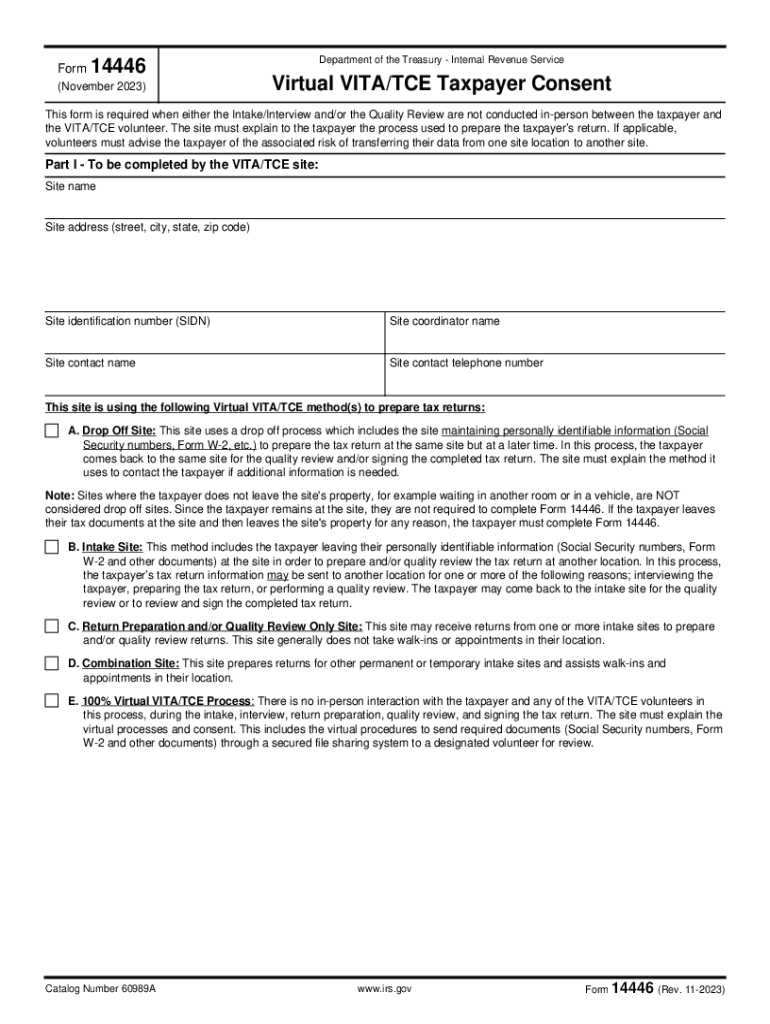

Form14446(November 2023)Department of the Treasury Internal Revenue ServiceVirtual VITA/TCE Taxpayer ConsentThis form is required when either the Intake/Interview and/or the Quality Review are not

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 14446 form

Edit your form 14446 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 14446 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 14446 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 14446. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 14446 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 14446

How to fill out IRS 14446

01

Begin by downloading IRS Form 14446 from the IRS website.

02

Enter your name and contact information in the designated sections.

03

Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

04

Indicate the tax year for which you are requesting help.

05

Specify the type of assistance you are seeking (e.g., questions about your tax return).

06

Sign and date the form at the bottom.

07

Review the completed form for accuracy and completeness.

08

Submit the form as instructed, either via mail or electronically if possible.

Who needs IRS 14446?

01

Individuals who require assistance with their tax return and need to communicate with the IRS.

02

Taxpayers who have questions or difficulties relating to their taxes for the specified tax year.

03

People who may need help accessing tax information or resolving issues with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I download my CRA tax form?

view, download and print the package at canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

What is the IRS consent form 4506 C?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

How do I download my tax return as a PDF?

View Return as PDF Sign in to your TaxAct Online return. Click the My Return button in the top right corner of the screen. Click Print Center, then click the Return tab (or one of the other tabs, depending on what you want to print) Enter the number of Federal and/or State return copies you would like to print or save.

What is an IRS consent to use form?

What are Consents? Consents are paper or electronic documents that contain specific information, including the names of the tax return preparer and the taxpayer. They are customized to include the specific use or disclosure.

How do I get a T4 PDF from CRA?

How Can I Get My T4? If you need a T4 slip for the current tax year, your employer should be able to provide it to you. For previous tax years, you can request a copy from the Canada Revenue Agency (CRA) or by calling 1-800-959-8281. Get Your T4 and Other Tax Forms Online From CRA's “Auto-fill my return”

What is an IRS form 14446?

Form 14446. (November 2022) Department of the Treasury - Internal Revenue Service. Virtual VITA/TCE Taxpayer Consent. This form is required when any part of the tax return preparation process is completed without in-person interaction between the taxpayer and the VITA/TCE volunteer.

How do I save a T4 as a PDF?

Choose on the left side the form you want to print in PDF or XPS. On the top right side click on the printer drop down menu and choose the PDF printer or XPS writer. Click OK. Next time you are printing a receipt, invoice or cheque you will be able to choose a location and save the XPS or PDF file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 14446?

The editing procedure is simple with pdfFiller. Open your IRS 14446 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out IRS 14446 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IRS 14446. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete IRS 14446 on an Android device?

Use the pdfFiller mobile app and complete your IRS 14446 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IRS 14446?

IRS Form 14446 is a document used to request a waiver for the requirement to e-file certain tax forms, primarily for tax-exempt organizations operating in specific circumstances.

Who is required to file IRS 14446?

Tax-exempt organizations that are unable to e-file their returns due to reasonable cause are required to file IRS Form 14446.

How to fill out IRS 14446?

To fill out IRS Form 14446, organizations must provide their name, address, Employer Identification Number (EIN), and details explaining the reason for the e-filing waiver request.

What is the purpose of IRS 14446?

The purpose of IRS Form 14446 is to allow tax-exempt organizations to formally request an exemption from the e-filing mandate when they can demonstrate a valid reason.

What information must be reported on IRS 14446?

IRS Form 14446 must report the organization's name, address, EIN, and a detailed explanation of the circumstances that prevent the organization from e-filing.

Fill out your IRS 14446 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 14446 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.